Five Forces Analysis Apple Inc.

These five forces are as follows, with the ratings alongside in the concept of Apple smartphones; Competitive rivalry or competition (strong force), Bargaining power of buyers or customers (strong force), Bargaining power of suppliers (weak force), Threat of substitutes or substitution (weak force), Threat of new entrants or new entry (moderate.

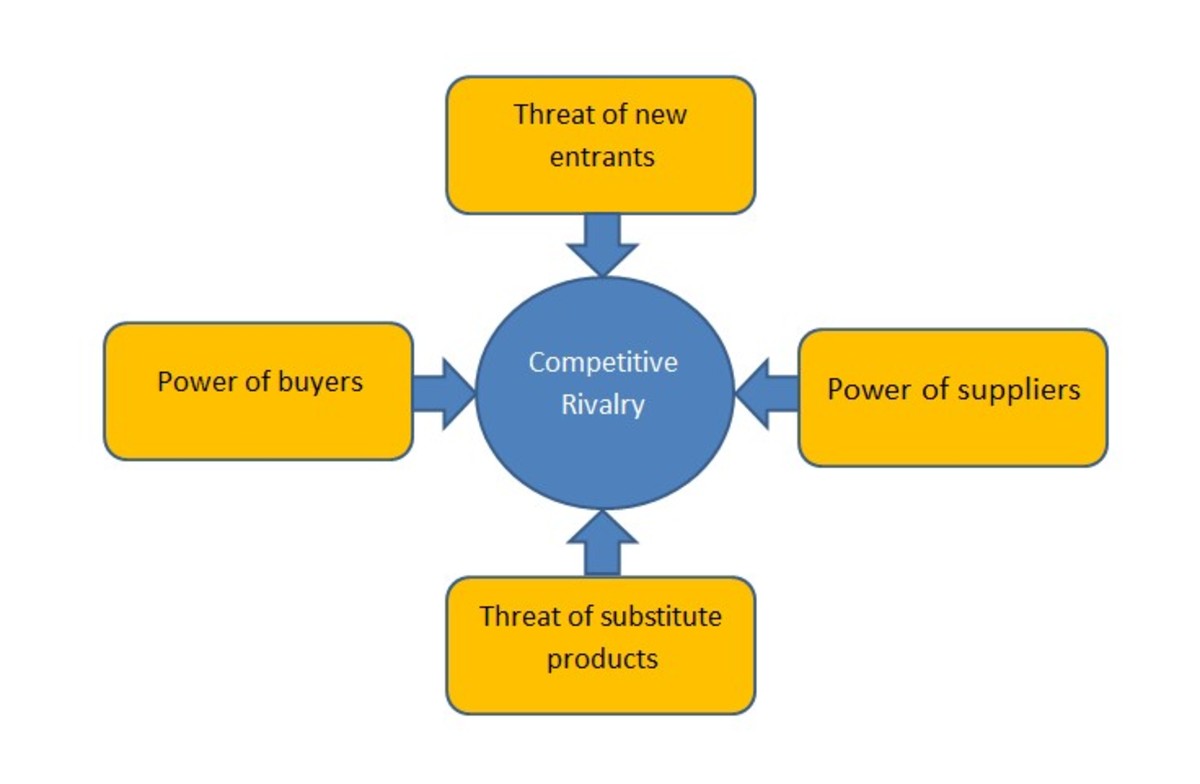

Porter’s Five Forces Analysis

A model was put forward by Michael. E. Porter in an article in the Harvard Business Review in 1979. This model, known as Porter's Five Forces Model is a strategic management tool that helps determine the competitive landscape of an industry. Each of the five forces mentioned in the model and their strengths help strategic planners understand the inherent profit potential within an industry. The strengths of these forces vary across the industry to industry, which means that every industry is different regarding the profitability and attractiveness. The structure of an industry, even though it is stable, can change over time. These Porter’s five forces are as follows:

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute Products or Services

- Rivalry Among Existing Firms

- Analysis of industry competition Competition in a given industry is defined by the Micheal Porter’s five competitive forces shown in figure 3. This model can help to evaluate the impact on Apple and its ability to compete in market.

- The report will provide a SWOT analysis of Apple Inc. Its include strengths, weaknesses, opportunities and threats. Which is useful for a reader to understand how Apple Inc. Became big success in the business and use strength to overcome their weakness also the threats of the competition also the recommendation for the Apple.

The Porter’s Five Forces model can be used to analyse the industry in which Apple Inc operates, in terms of attractiveness through inherent profit potential. The information analysed using the model can be used by strategic planners for Apple Inc to make strategic decisions.

Apple Inc Porter’s Five Forces Analysis

This section analyses Apple Inc using each of the five forces of Porter’s model.

Threat of New Entrants

- The economies of scale is fairly difficult to achieve in the industry in which Apple Inc operates. This makes it easier for those producing large capacitates to have a cost advantage. It also makes production costlier for new entrants. This makes the threats of new entrants a weaker force.

- The product differentiation is strong within the industry, where firms in the industry sell differentiated products rather a standardised product. Customers also look for differentiated products. There is a strong emphasis on advertising and customer services as well. All of these factors make the threat of new entrants a weak force within this industry.

- The capital requirements within the industry are high, therefore, making it difficult for new entrants to set up businesses as high expenditures need to be incurred. Capital expenditure is also high because of high Research and Development costs. All of these factors make the threat of new entrants a weaker force within this industry.

- The access to distribution networks is easy for new entrants, which can easily set up their distribution channels and come into the business. With only a few retail outlets selling the product type, it is easy for any new entrant to get its product on the shelves. All of these factors make the threat of new entrants a strong force within this industry.

- The government policies within the industry require strict licensing and legal requirements to be fulfilled before a company can start selling. This makes it difficult for new entrants to join the industry, therefore, making the threat of new entrants a weak force.

How Apple Inc can tackle the Threat of New Entrants?

- Apple Inc can take advantage of the economies of scale it has within the industry, fighting off new entrants through its cost advantage.

- Apple Inc can focus on innovation to differentiate its products from that of new entrants. It can spend on marketing to build strong brand identification. This will help it retain its customers rather than losing them to new entrants.

Bargaining Power of Suppliers

- The number of suppliers in the industry in which Apple Inc operates is a lot compared to the buyers. This means that the suppliers have less control over prices and this makes the bargaining power of suppliers a weak force.

- The product that these suppliers provide are fairly standardised, less differentiated and have low switching costs. This makes it easier for buyers like Apple Inc to switch suppliers. This makes the bargaining power of suppliers a weaker force.

- The suppliers do not contend with other products within this industry. This means that there are no other substitutes for the product other than the ones that the suppliers provide. This makes the bargaining power of suppliers a stronger force within the industry.

- The suppliers do not provide a credible threat for forward integration into the industry in which Apple Inc operates. This makes the bargaining power of suppliers a weaker force within the industry.

- The industry in which Apple Inc operates is an important customer for its suppliers. This means that the industry’s profits are closely tied to that of the suppliers. These suppliers, therefore, have to provide reasonable pricing. This makes the bargaining power of suppliers a weaker force within the industry.

How Apple Inc can tackle the Bargaining Power of Suppliers?

- Apple Inc can purchase raw materials from its suppliers at a low cost. If the costs or products are not suitable for Apple Inc, it can then switch its suppliers because switching costs are low.

- It can have multiple suppliers within its supply chain. For example, Apple Inc can have different suppliers for its different geographic locations. This way it can ensure efficiency within its supply chain.

- As the industry is an important customer for its suppliers, Apple Inc can benefit from developing close relationships with its suppliers where both of them benefit.

Bargaining Power of Buyers

- The number of suppliers in the industry in which Apple Inc operates is a lot more than the number of firms producing the products. This means that the buyers have a few firms to choose from, and therefore, do not have much control over prices. This makes the bargaining power of buyers a weaker force within the industry.

- The product differentiation within the industry is high, which means that the buyers are not able to find alternative firms producing a particular product. This difficulty in switching makes the bargaining power of buyers a weaker force within the industry.

- The income of the buyers within the industry is low. This means that there is pressure to purchase at low prices, making the buyers more price sensitive. This makes the buying power of buyers a weaker force within the industry.

- The quality of the products is important to the buyers, and these buyers make frequent purchases. This means that the buyers in the industry are less price sensitive. This makes the bargaining power of buyers a weaker force within the industry.

- There is no significant threat to the buyers to integrate backwards. This makes the bargaining threat of buyers a weaker force within the industry.

How Apple Inc can tackle the Bargaining Power of Buyers?

- Apple Inc can focus on innovation and differentiation to attract more buyers. Product differentiation and quality of products are important to buyers within the industry, and Apple Inc can attract a large number of customers by focusing on these.

- Apple Inc needs to build a large customer base, as the bargaining power of buyers is weak. It can do this through marketing efforts aimed at building brand loyalty.

- Apple Inc can take advantage of its economies of scale to develop a cost advantage and sell at low prices to the low-income buyers of the industry. This way it will be able to attract a large number of buyers.

Threat of Substitute Products or Services

- There are very few substitutes available for the products that are produced in the industry in which Apple Inc operates. The very few substitutes that are available are also produced by low profit earning industries. This means that there is no ceiling on the maximum profit that firms can earn in the industry in which Apple Inc operates. All of these factors make the threat of substitute products a weaker force within the industry.

- The very few substitutes available are of high quality but are way more expensive. Comparatively, firms producing within the industry in which Apple Inc operates sell at a lower price than substitutes, with adequate quality. This means that buyers are less likely to switch to substitute products. This means that the threat of substitute products is weak within the industry.

How Apple Inc can tackle the Threat of Substitute Products?

- Apple Inc can focus on providing greater quality in its products. As a result, buyers would choose its products, which provide greater quality at a lower price as compared to substitute products that provide greater quality but at a higher price.

- Apple Inc can focus on differentiating its products. This will ensure that buyers see its products as unique and do not shift easily to substitute products that do not provide these unique benefits. It can provide such unique benefits to its customers by better understanding their needs through market research, and providing what the customer wants.

Rivalry Among Existing Firms

- The number of competitors in the industry in which Apple Inc operates are very few. Most of these are also large in size. This means that firms in the industry will not make moves without being unnoticed. This makes the rivalry among existing firms a weaker force within the industry.

- The very few competitors have a large market share. This means that these will engage in competitive actions to gain position and become market leaders. This makes the rivalry among existing firms a stronger force within the industry.

- The industry in which Apple Inc is growing every year and is expected to continue to do this for a few years ahead. A positive Industry growth means that competitors are less likely to engage in completive actions because they do not need to capture market share from each other. This makes the rivalry among existing firms a weaker force within the industry.

- The fixed costs are high within the industry in which Apple Inc operates. This makes the companies within the industry to push to full capacity. This also means these companies to reduce their prices when demand slackens. This makes the rivalry among existing firms a stronger force within the industry.

- The products produced within the industry in which Apple Inc operates are highly differentiated. As a result, it is difficult for competing firms to win the customers of each other because of each of their products in unique. This makes the rivalry among existing firms a weaker force within the industry.

- The production of products within the industry requires an increase in capacity by large increments. This makes the industry prone to disruptions in the supply-demand balance, often leading to overproduction. Overproduction means that companies have to cut down prices to ensure that its products sell. This makes the rivalry among existing firms a stronger force within the industry.

- The exit barriers within the industry are particularly high due to high investment required in capital and assets to operate. The exit barriers are also high due to government regulations and restrictions. This makes firms within the industry reluctant to leave the business, and these continue to produce even at low profits. This makes the rivalry among existing firms a stronger force within the industry.

- The strategies of the firms within the industry are diverse, which means they are unique to each other in terms of strategy. This results in them running head-on into each other regarding strategy. This makes the rivalry among existing firms a strong force within the industry.

How Apple Inc can tackle the Rivalry Among Existing Firms?

- Apple Inc needs to focus on differentiating its products so that the actions of competitors will have less effect on its customers that seek its unique products.

- As the industry is growing, Apple Inc can focus on new customers rather than winning the ones from existing companies.

- Apple Inc can conduct market research to understand the supply-demand situation within the industry and prevent overproduction.

Implications of Porter Five Forces on Apple Inc

By using the information in Apple Inc five forces analysis, strategic planners will be able to understand how different factors under each of the five forces affect the profitability of the industry. A stronger force means lower profitability, and a weaker force means greater profitability. Based on this a judgement of the industry's profitability can be made and used in strategic planning.

Apple Inc. has gained massive success through Macintosh operating system and computers as well as iPhone, iPad, and other products despite the up and down cycles it has gone through since 1976, the year it was founded (Beagle, 2011). In 2014, the company achieved a key distinction by becoming the 1st company in the U.S. to ever reach a market capitalization exceeding $ 700 billion (Mohammd & Alam, 2015). Its success largely depends upon its creative ability to invent and create unique products in the market continually. This dependence has considerably engendered brand loyalty. Apple's marketing strategies and product development depict its awareness of the need to deal with the main marketplace forces that can make an impact on its profitability and market share.

Apple in the Marketplace from a Five Forces Perspective

Industry Competition

The level of rivalry among the major companies that are in direct competition with Apple in the technology industry is rather high. Apple directly competes with such companies as Samsung Electronics Co., Google, Inc, Amazon, and Hewlett-Packard Company (Beagle, 2011). All of these companies expend huge capital on marketing, research, and development similar to Apple does. Indisputably, the competitive force influencing the industry is strong. One factor that contributes to the high level of competitiveness in the industry is low switching costs (HBR, 2014). It means that it hardly takes a substantial amount of investment for a consumer to abandon Apple's iPhone in favor of Google Pixel phone. The threat of marketplace competition has earned a mammoth consideration from this technology company, and it has responded amicably by concentrating on product differentiation to strengthen and increase the position of market share (Beagle, 2011). For instance, according to the research outfit Canaccord Genuit, approximately more than 1000 companies produce Smartphones in the world, but Apple has still reaped 92% of all profits gained by the top eight makers of Smartphones in the world in the 1st quarter of 2015 (Mohammd & Alam, 2015). Therefore, the external factors influencing Apple are high aggressiveness and low switching costs which are both strong forces.

Bargaining Power of Buyers

The occurrence of low switching cost in the industry gives strength to buyers' bargaining power, thus, becoming a major force for Apple, which is worth considering. Within this force, there are basically two points of analysis, namely: individual bargaining power of buyers and their collective power to bargain (Magretta, 2011). For Apple, losing a single customer corresponds to a negligible amount of revenue (Mohammd & Alam, 2015). Thus, the individual power to bargain is a weak force to this company. However, it is important to note that the customers' collective bargaining power in the marketplace and the possibility of mass exodus to a competitor is a strong force. Apple responds to the influence of this strong force by increasing huge capital expenditures in Research and Development to enable investments in unique products such as the Apple Watch and Apple Pay as well as establishing momentous brand loyalty (Mohammd & Alam, 2015). Apple has enjoyed a long period of success in this segment of competition evidenced by a large customer base who, primarily, would not change their iPhones for a different phone from a competitor. In summary, the buyers' strong power is externally influenced by a small number of individual buyers, which is a weak and low switching force (a strong force).

Threat of New Entrants to the Marketplace

The threat of a new entrant in the industry that could pose a serious threat to Apple's share in the market is relatively low. This phenomenon results from two principal factors: the high cost of entrance in the industry and additional cost of creating a recognized brand name (Magretta, 2011). A new entrant faces already strong competitive industry with large and well-established firms (Porter, 2008). Another challenge is forming brand name recognition within an industry with very strong brand recognition that already dominated by many companies such as Apple, Amazon, and Google (Magretta, 2011). Although there is a possibility of a new entrant, possibly a Chinese company with enormous government financial support, challenging Apple's top position in the near future, the chances of such a firm arising to the highest level is totally remote. In short, the threat of a new entrant is a moderate force due to huge capital requirement (weak force), the capacity of a new entrant to perform extraordinarily (strong force) and high cost of developing a brand (weak force).

Bargaining Power of Suppliers

This force is relatively weak within the marketplace for Apple's products. Despite having less than two hundred suppliers, Apple has a variety of options because of a large number of suppliers globally (Mohammd & Alam, 2015). The industries of the suppliers of its parts are highly competitive as with the firms manufacturing computer processors. Apple also enjoys relatively low switching cost, if necessary, from one supplier to another. Moreover, it serves as a major customer for its suppliers; hence, any supplier must be very reluctant to lose Apple (Beagle, 2011). This condition weakens the ability of suppliers to impose their demands on the company (HBR, 2014). This part of Porter's five forces analysis indicates that Apple gives almost zero consideration to the bargaining power of suppliers while creating strategies for industry leadership and innovation (Magretta, 2011). Therefore, suppliers have weak bargaining power due to the high overall supply (weak force) and a high number of suppliers (weak force).

How It Works

Pay for it

Download your paper

Threat of Substitutes or Substitution

In the framework of Porter's model, substitute products are not the ones in direct competition with the products of the company but possible replacements. In this case, the landline telephone is a good example of a substitute for iPhone. The influence of this force is relatively low for Apple products because the substitutes have limited capabilities compared to them (Magretta, 2011). For example, iPhone has immense capabilities compared to a landline which can only make calls. Thus, the influence of substitution on Apple's business is weak due to the high availability of substitutes (emerging as a moderate force) and the low performance of substitutes (weak force). This part of the model depicts that Apple hardly prioritizes this kind of threat in the business processes such as product design, development, and marketing.

The five forces analysis of this giant company's position in the technology sector indicates that the buyers' bargaining power and competition in the industry are the strongest marketplace forces that influence Apple's profitability (Porter, 2008). The other three are regarded as weaker elements among the major forces in the industry.

Apple Generic Strategy

Generic strategy employed by this company is broad differentiation over cost leadership. It focuses on specific features that differentiate it and its products from the competitors. Apple's ecosystem is its biggest competitive advantage (Mohammd & Alam, 2015). According to CEO Time Cook, Apple is distinguished from other competitors by its expertise in hardware, software, and services (Beagle, 2011). Apple emphasizes elegant designs, high-end branding, and user-friendliness. This strategy has been effective in differentiating the company. For example, iPhone 7 is the first phone in the world to come without an opening for a headphone jack. Apple operates in an almost closed ecosystem with proprietary stores (Nawaz, Abbas & Rasheed, 2015). Consequently, the company gains more control of its value chain and component costs. It has a popular and tightly integrated ecosystem of all the companies in the world involved in technology products. Apple's software and devices are compatible with one another and can synchronize to enable sharing and copying of media and preferences with many devices.

Apple has defined its target consumers, and, regardless of the environment where it markets its products, the company has never made price-friendly products like its competitors such as Samsung. For example, to capture the African market, Samsung produces phones costing as much as $20. A study conducted by a research firm GfK in 2011 indicates that 84% of people owning iPhone plan to buy another Apple handset when they eventually replace their cell phone (Beagle, 2011). The study also indicated that more than 70% of consumers are constantly attracted by uninterrupted access to unlimited contents and features offered by mobile OS (Beagle, 2011). Since the push for an ecosystem with an enhanced value addition is a greater priority in the technology industry, the tendency of establishing brands to lure customers from competitors has reduced (Jinjin, 2013). As a result, the richest reward is enjoyed by providers with the ability to create brand loyalty and build the most harmonious user experience (Mohammd & Alam, 2015). A recent study conducted by the United States Congress on trade between the U.S. and China revealed that Apple innovation, while engineering and developing iPod and its ability to shift its production to low-cost countries, has enabled it to increase profitability and gain competitive advantage and simultaneous source for high-paying jobs within the border of U.S. (Mohammd & Alam, 2015). Therefore, creativity and innovation has enabled the company to enhance product differentiation that has fueled its dominance in the market.

Apple Inc. SWOT Analysis

The current success of Apple Inc's results from its ability to utilize its strengths in overcoming threats and weaknesses and exploiting available opportunities.

Strengths

Innovation: Apple enjoyed strong visionary leadership of Steve Jobs with a knack for keeping the pace of the fast-moving technology curve. This was evident since the launching of iPhone in 2007 and iPad in 2010 as mobile internet devices. For instance, the recently launched iPhone 7 and iPhone 7 plus come with the latest aspects of iPhone experience not found with any other rival, for example, scratch, splash, and dust resistance.

Rock-Solid Finances: The Company has consistently been a cash cow since the launch of iPhone (Jinjin, 2013). Apple amasses exceptionally high margins of profit compared to the average margins in the industry thereby giving it the advantage to conduct business at multiple levels.

Brand Image: Apple enjoys a strong brand image, and the company has continued to be the most valuable company with the value of $124.4 billion (Mohammd & Alam, 2015).

VIP Services for Premium Quality

10,95 USD

Get order prepared by Top 10 writers

11,55 USD

Get VIP Support

4,60 USD

Get order Proofread by editor

2,00 USD

Get extended REVISION

Five Forces Analysis Apple Inc. Price

3,00 USD

Get SMS NOTIFICATIONS

2,00 USD

Get additional PLAGIARISM CHECK

Five Forces Analysis Apple Inc. Download

34,10 USD

23,87 USD

VIP Services

package

Weaknesses

Premium Pricing: The Company's computing devices are classically among the most priced products on the market. However, Apple attempted to expand into the large value segment following the launch of its scaled-down iPhone 5C in 2013. Unlike other similar models, it did not come with a great commercial success. The luxury positioning has hampered its ability to make substantial inroads in countries with considerable pressures on ordinary consumers (Jinjin, 2013). It also exposed the vulnerability of the company to price competition from Samsung.

Opportunities

Market-Share Growth: Even though the company has had a historic growth spurt in the past, it continues to enjoy plenty of room for extending the share of the traditional computing space. Presently, Apple has about -20% piece of the global PC/tablet pie, more than the competitors such as Samsung and Lenovo. However, this number is yet to increase in the coming years even as it gains ground in China and other parts of Asia/ Pacific region (Mohammd & Alam, 2015).

Threats

Competition:Rivalry is the biggest threat to any tech outfit, considering the persistent product cycles and the rapid move towards commoditization in the industry and the fickle nature of consumers today (Nawaz, Abbas & Rasheed, 2015). Cannibalization has been a big concern here even as it expands to mobile Internet devices.

Gross Margin Pressures: These pressures shoot from increased competition and consequential loss of pricing power, product shortages and increasing component prices (Nawaz, Abbas & Rasheed, 2015). An unfavorable mix budges away from the dominant iPhone line and could reduce profit margins as well.

Apple's Grand Strategy into the Future

Given Apple's grand reality, product development is the main intensive growth strategy. This strategy requires offering attractive products to ensure growth in its market performance and share. With a decline in core iPhone business, the company requires new businesses to boost earnings and sales. Lately, Apple has focused its attention on providing booming services built around the large ecosystem of users (Nawaz, Abbas & Rasheed, 2015). In 2014, Apple partnered with IBM in order to keep enterprise customers in mind (Mohammd & Alam, 2015). The step signified the company's actions to diversify its keys strategy of product development.

In conclusion, this article analyzes Apple Inc. based on Michael Porter's five forces in relation to its position in the industry and its external structure including the key operations to develop and sustain a competitive advantage in the market. At present, the company is successful in sales and enjoys the highest customer satisfaction ratio. In addition, Apple works on cost minimization and broadens the board of directors to foster corporate governance.